Sekhon Family Office SFO deploys capital through various types of funds. We are sector and geography agnostic. Sekhon Family Office offers registered fund products focused on following. Sekhon Family Office offers registered fund products here.

Investing Principles

- SFO invests for the long term because building successful, resilient businesses can lead to better returns, stronger communities and economic growth that works for everyone.

- We invest across asset classes on behalf of sovereign funds, pension funds, university endowment funds, insurance funds, private equity, family offices and other leading institutions.

- Providing Financial Security — We serve institutional investors around the world, including retirement systems that represent tens of millions of teachers, firefighters and other pensioners. Our investments are designed to preserve and grow our clients’ capital across market cycles.

- Investing Globally — We invest on a global basis across a wide range of asset classes including private equity, real estate, public debt and equity, growth equity, opportunistic, non-investment grade credit, real assets and secondary funds.

- Making a Positive Impact — We seek to drive economic growth and make a positive impact. We do this by using extraordinary people and flexible capital to help companies solve problems, and to engage with our local communities.

- The Principles that Matter Most — Accountability • Excellence • Integrity • Teamwork • Entrepreneurship . Everything we do is guided by these principles, which define our character and culture; they have been at the core of Blackstone since its inception. These enduring qualities are the shared convictions that we bring to our professional and personal conduct. They are a fundamental strength of our business.

- Our People — We focus on attracting exceptionally talented people and rewarding initiative, independent thinking and integrity. Our team’s breadth of skills and deep expertise are a critical source of intellectual capital.

- Our Scale — Investing across regions, industries and asset classes gives us the knowledge, resources and critical mass to take advantage of opportunities on a global scale.

- Our Performance — Our performance is characterized by superior risk-adjusted returns across a broad and expanding range of asset classes and through all types of economic conditions.

Participation

- To participate in our future fund rounds please submit your project with us here and we’ll contact you soon.

- To get insights about our various funds, please visit our insights section here.

- And regardless, we’d love to hear from you whether you’d like to learn more about our programs, partner with our work, or simply get to know us a little better! We look forward to hearing from you!

Private Equity

- We play a vital role in helping companies realize their growth potential. We uncover and unlock value by identifying great companies with untapped potential and enhancing their performance.

- We invest across industries in both established and growth-oriented businesses across the globe.

- Our Portfolio — We are proud of SFO’s role as a positive economic catalyst for the companies in our Corporate Private Equity portfolio. We work to identify, invest in and enhance the value of great businesses.

- Disciplined Due Diligence — Our investment approach is based on a disciplined due diligence process that measures risk while identifying the catalysts for increased value. We engage only in friendly transactions and work with talented management teams to achieve positive results.

- Transformative Impact — We strive to create value by investing in great businesses where our capital, strategic insight, global relationships and operational support can drive transformation.

- Staying Power — When we partner with a business, we focus on building it to last. Our staying power, drawn from the scale and breadth of the platform we’ve grown over 35 years, helps our companies withstand market cycles and succeed for the long term.

Real Estate

- We are a global leader in real estate investing. We seek to utilize our global expertise and presence to generate attractive returns for our investors in any environment, and to make a positive impact on the communities in which we invest.

- We invest thematically in high-quality assets, focusing where we see outsized growth potential driven by global economic and demographic trends.

- Our Portfolio — Our real estate portfolio includes logistics, rental housing, office and life science office, hospitality and retail properties around the world.

- Conviction — Our vast portfolio provides us with proprietary information across every major real estate asset class in virtually every major market around the world, allowing us to identify themes and invest capital with conviction.

- Connectivity — Our people are our advantage allowing us to identify the opportunities and limits of each potential transaction through one investment review process.

- Scale — Scale is one of our greatest strengths. The breadth of our existing portfolio gives us differentiated perspectives across sectors and geographies, while our significant discretionary capital base enables us to execute large and complex transactions.

- Our Strategies — Since we started investing in real estate in, the growth of our business across both products and geographies has expanded our ability to provide practical and diverse solutions to our limited partners. We have invested successfully through all market cycles and across the entire risk spectrum.

- Opportunistic — Our opportunistic business seeks to acquire undermanaged, well-located assets across the world. In connection with these acquisitions, we build businesses that are set up to manage the underlying properties and ultimately maximize their value by instituting best-in-class management. Post-acquisition, we also invest in the properties to improve them before selling the assets and returning capital to our limited partners.

- Core — Our Core+ strategy features stabilized real estate with a long-term investment horizon and moderate leverage, where we can unlock additional value through focused asset management. Our funds focus on logistics, residential, office and life science office, and retail assets in global gateway cities. Our non-listed REIT, focuses on income-generating assets primarily in the top 50 U.S. markets.

- Debt — Our real estate debt business provides creative and comprehensive financing solutions across the capital structure and risk spectrum. We originate loans and invest in debt securities underpinned by high-quality real estate. We manage a leading real estate finance company that originates senior loans collateralized by commercial real estate.

- Real Estate — Real Estate Income Trust, Real Estate Income Fund, Mortgage Trust

Credit

- We are one of the world’s largest credit-oriented asset managers, with a focus on delivering capital preservation and attractive risk-adjusted returns for our clients regardless of market conditions.

- We invest in public and private corporate credit instruments across multiple strategies.

- Our Portfolio — We seek to make companies stronger by providing capital when other funding is unavailable or where our expertise and scale enable uniquely flexible capital solutions.

- Team — Our business, has a deep reservoir of credit and industry expertise across the entire range of market cycles. Our senior investment professionals have an average of 21 years of industry experience.

- Scale — Scale allows us to provide financing solutions that enhance a corporation’s financial flexibility, while capturing opportunities our investors might have otherwise missed. Our capital has supported a wide range of companies, enabling businesses to expand, invest, and navigate changing market environments.

- Solutions — The solutions we offer are not often available elsewhere in the credit markets. Their breadth is our competitive advantage — drawing upon a wide range of disciplines, including loans, high yield and investment grade bonds, structured credit, mezzanine lending and rescue financing.

- Our Strategies — Our activities range from investing in public debt that offers attractive risk-adjusted returns to providing private capital to companies. This allows us to maximize potential in various market conditions, and in times of both stability and volatility.

- Loans, High Yield and Investment Grade Bonds — Our U.S. and European loan, high yield and investment grade bond strategies rely on bottom-up fundamental analysis and investing discipline. Given our scale as one of the largest CLO managers in the world, we are also able to source differentiated investments and commit capital in size.

- Systematic Strategies — Through acquisition of of pioneering companies in deploying a technology-enabled, fundamental based, systematic approach to credit investing, we manage additional strategies across global investment grade, high yield, and emerging corporate credit markets. We can now offer a full range of fundamental discretionary and systematic credit solutions to our clients and believe the combination of these fundamental based approaches further strengthens and differentiates our credit investment capabilities.

- CLO Investing — We have a dedicated global CLO investing team that utilizes both proprietary technology and the expertise of our large credit research team to invest in primary and secondary CLO opportunities. The team evaluates all parts of the CLO capital structure, from investment grade notes to equity, across many different managers in the U.S. and Europe to seek the best risk adjusted returns for investors.

- Direct Lending — We provide privately originated, senior secured, floating rate loans to U.S. and European middle market companies. We partner with these firms and their sponsors to understand their businesses, address their challenges and support their long-term strategies.

- Mezzanine — Our mezzanine business has a flexible mandate that provides privately negotiated capital to companies in connection with leveraged buyouts, acquisitions, recapitalizations and growth financings. Our expertise in these areas helps companies navigate change while generating attractive returns for our investors.

- Stressed / Distressed Debt — We partner with stressed and distressed companies, both public and private, to solve balance sheet problems. Our rigorous investing approach is designed to preserve principal while offering flexible capital solutions where they are needed most. Stressed Assets — Alternative Investment Funds (AIFs), Asset Reconstruction Companies (ARCs), Non-Banking Finance Companies (NBFCs).

- Energy — Deep industry expertise underpins our energy business, which provides capital solutions for performing and distressed energy companies. By operating across the capital structure, we can respond quickly and creatively to companies’ needs.

- Credit — Growth / Business Development Companies, Closed End Funds, Interval Funds, Exchange Traded Fund, Listed Funds.

Hedge Fund Solutions

- SFO invests in alternative investment strategies for leading institutional investors and sophisticated individuals, seeking attractive risk-adjusted returns to meet our clients’ investment goals.

- We provide access to alternative investment strategies through portfolios of hedge funds, registered liquid funds, direct investing, manager seeding and general partner ownership.

- Partnership — We seek to build strategic partnerships with our clients, creating solutions designed to meet their specific objectives. Additionally, by forging long-term partnerships with talented investment managers and leveraging our position in the industry, we strive to negotiate attractive terms for our clients.

- People — Our deep and experienced team has the expertise to access differentiated exposures across a spectrum of alternative investment activities. The quality of our people is a key driver of our success.

- Position — Our scale and breadth of relationships, coupled with Blackstone’s global reach, allow us to better identify, evaluate and implement new investments. Our size also gives us the ability to negotiate customized mandates and improved terms with managers, which directly benefit our investors.

- Our Strategies

- Hedge Fund Portfolio Solutions — We build customized portfolios of alternative investment strategies. As a market leader in hedge fund solutions, we have built lasting and valuable partnerships with underlying managers. Our rigorous process for evaluating managers and opportunities is critical to our success.

- Registered Funds — We deliver institutional-caliber investment exposures to individuals and their financial advisors in easily accessible, registered funds that employ the same disciplined investment process and utilize the same experienced team that has long served our institutional clients. Our liquid, open-end and closed-end funds provide access to some of our largest manager relationships.

- Special Situations — We directly invest in special situations and other differentiated opportunities that we source through our vast network. The size and scale of our platform, combined with our deep relationships across the industry, give us access to interesting deal flow and idea generation. They also provide us with considerable resources to research and manufacture new exposures.

- General Partnership Stakes and Seeding — We seek to partner with talented managers at all stages of their life cycles. We provide seed capital to emerging managers to help them grow and stabilize their businesses, and we acquire minority stakes in established managers, serving as a strategic partner to help them build enduring franchises.

- Hedge Fund Solutions — Closed End Funds, Mutual Funds, UCITS Fund

MSME / SME Finance Funds

- Early Stage SME Finance

- Lines Of Credit

- Partial Credit Guarantees

- Supporting women owned SME’s

Hydrogen Investment Fund

- Hydrogen Vehicles

- Hydrogen Fuelling Infrastructure

Women Empowerment Fund

The Women Empowerment Fund at SFO is deepening impact by Investing in Women. Our Gender Lens investing includes initiatives with

- Women as business owners;

- Women as business leaders (such as CEOs);

- Women as employees;

- Women as customers; and

- Women in the supply chain.

Disaster Management Funds

- Natural Disasters

- Pandemics

- Wars

Geographic Funds

- Our geography-based investment theme page comprises funds and ETFs neatly organized under various region-specific themes. This could range from narrow region-specific strategy (i.e. country-specific like China or Germany) to broad region-specific strategy (i.e. developed markets).

- The geography theme page is specifically suited for investors willing to look worldwide to either enjoy geographic diversification benefits or any other region-specific benefits. Typically, they have higher risk-appetite and are willing to accept currency and geopolitical risks, which are typically associated with this investment theme.

1. SFO US Growth Fund Investment Objective

- The US Growth Fund seeks to maximise total return. The Fund invests at least 70% of its total assets in the equity securities of companies domiciled in, or exercising the predominant part of their economic activity in, the US. Majorly the companies shall come from the following industrial belts in the USA. SFO also has relationships with 450 global exchanges to help companies with.

- East North Central

- East South Cetral

- Mid Atlantic

- Mountain

- The New England Regions

- ]Pacific

- Puerto Rico & The Island Areas

- South Atlantic

- West North Central

- West South Central

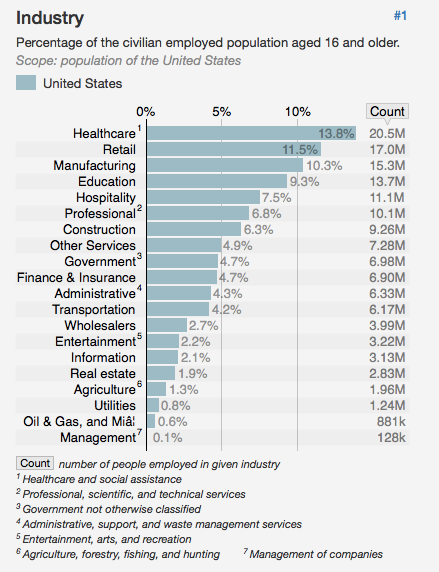

- The Fund places particular emphasis on companies in the following sectors that ( that employ the largest population in descending order Healthcare, Retail, Manufacturing, Eduction, Hospitality, Professional, Construction, Other Services, Government, Finance & Insurance, Administrative, Transportation, Wholesalers, Entertainment, Information, Real Estate, Agriculture, Utilities, Oil & Gas, Metals, Management), in the opinion of the Investment Adviser, exhibit growth investment characteristics, such as above-average growth rates in earnings or sales and high or improving returns on capital.

- SFO is also working on national, state and county level roadmaps to double the GDP and make macroeconomic factors based KPI for Better Governance. These inputs advice our investments.

- We adopt ESG, impact and sustainability measures while finalizing our portfolio.

- The fund seeks capital appreciation by investing predominantly in equity securities of companies that the investment manager believes offer compelling growth opportunities. The investment manager considers many factors in the selection criteria, including historical and potential growth in revenues and earnings, assessment of strength and quality of management, and determination of a company’s strategic positioning in its industry.

- The Portfolio seeks to provide capital growth over the longer term. The Portfolio will mostly hold shares or similar instruments relating to US companies. Such companies are either based in or earn most of their profits or revenues from the US. The Portfolio may also invest in companies which are based anywhere in the world.

- Market participants often underestimate the pace and duration of growth. We aim to add value with differentiated, long-term views and a focused portfolio of securities.

- We use bottom-up research to identify companies with compelling and sustainable growth trajectories whose current valuations don’t reflect our views of their long-term prospects. Our process emphasizes factors such as quality, market share, competitive positioning, and the evolution of innovation.

Reasons To Consider Investing

- Focused Portfolio — A focused portfolio of 30–40 high quality growth businesses that represents the team’s high conviction investment ideas and is based on our disciplined strategy.

- Rigorous Process — Secular growth drivers are carefully considered in the stock selection process, such as: advancing communications, global energy supply/demand imbalance, demographic trends, expanding global markets and technological advances in healthcare.

- Long-Term View — The strategic long-term growth capabilities of a business are evaluated rather than short-term factors, such as stock price, momentum, sector rotation, or current quarterly earnings.

- Access to a deep and experienced Team — The US Large/Mid Cap Team consists of over 20 investment professionals averaging 15 years of industry experience. Sector analysts conduct rigorous fundamental analysis to identify potential investment opportunities. Lead Portfolio Managers follow a centralized approach to decision-making and leverage the broader team for investment ideas.

2. SFO- Africa Growth Fund-Invest in Africa

- As the second largest continent in the world and home to over 1.2 billion people, Africa offers a variety of investment options. To strive to capture this unique investment opportunity, SFO Funds developed the Africa Fund designed to potentially benefit from the emerging African economies and growing consumerism.

- This strategy allows the Fund to access companies involved in diverse industries, such as financial products, healthcare initiatives, transportation, tourism, power generation facilities, sanitation and clean water production, and industrial manufacturing. The Africa Fund provides investors the opportunity to invest in the continent of Africa, a region where limited dedicated funds are available.

- Various government inter-country alliances;

- Separate marketplaces where the financial instruments of the companies are traded;

- Legal framework and governance overseeing these endeavors; and

- Financial systems employed to provide information for the investing public.

- After thorough consideration of these and other factors, it is our opinion there are significant opportunities available which we believe represent long term potential. It is our goal to have many of these opportunities available through the Africa Fund portfolio, so you can bring it home.

- Investment Objective — The Fund’s investment objective is to provide long-term capital appreciation and current income. It invests primarily in equity and debt securities of Africa issuers.

SFO Stressed Assets Fund

- Globally macroeconomic troubles of various countries are attracting a new wave of global investors betting they can eke out profits from the rising number of capital-starved businesses struggling to stay afloat.

- Sensing opportunities from stalled companies and real estate projects and cash starved developers, Sekhon Family Office is launching an stressed assets funds.

- The proposed fund will focus on last-mile funding and acquisition of stressed companies, residential and commercial projects with an investment ticket size as below per transaction.

- Large Ticket Size (US$150m- 900m)

- Medium Ticket Size (US$50M- 150M)

- Small Ticket Size (US$15M- 50M) - The fund will independently evaluate and invest in various stressed assets and will rely on the GP’s operational expertise to manage recapitalized businesses.

- The proposed fund has tied up with lenders in the identified assets hich inlcudes global heavyweights such as biggest sovereign funds, pension funds, university endowment funds and others of the like of KKR, AION Capital, Apollo Global Management Inc, New York-based Cerberus, Ares Management Corp.-backed SSG Capital Management, Singapore-based DBS Group Holdings Ltd, London-based Nithia Capital, Goldman Sachs Group Inc, Global investment firm Varde Partners LP, Mumbai-based Kotak Investment Advisors, CarVal Investors, Blackstone, Lone Star Funds, Brookfield Asset Management and Oaktree Capital Group and many others to scale up our teams in the country in a push to invest in distressed assets.

- Such an approach will be more acceptable to both lenders and borrowers in cases where the promoters are not able to infuse funds and lenders are reluctant to take additional exposure.

Overview

- The partnership will seek to tap the potential business opportunity offered by the growing pile of stressed corporate assets in India

- At a time when the banking sector is seeing a sharp increase in non-performing assets and with very few investors willing to buy these, such funds could help relieve banks of some of these loans. Collectively, the 14 asset reconstruction companies (ARCs) in India have a total capital of just R3,000 crore (approximately $450 million).

- Transactions have been few and far between primarily for two reasons: — ARCs need to pay 15% of the debt value upfront which they perceive is high and moreover, banks typically are reluctant to offload assets at lower valuations.

- In other words, they are not willing to take too much of a haircut. ARCs charge between 1.5% and 2% of the asset value as the annual management fee. However, not too many transactions have turned out to be profitable for them.

- The problem with ARCs is that they simply don’t have the money to meet capital adequacy requirement leave aside making upfront payments to banks and that’s exactly where the new fund comes in.

- The fund is an experiment where real estate developers will join hands with an asset management company at an early stage to create a better eco system of fund raising when liquidity support from major financial institutions and NBFCs has dried.

- Stressed assets acquisition being more of operational play promoters and real estate developers, as operating partners in the acquisition of stressed assets and last-mile funding, will provide a unique win-win investment opportunity to investors where operational risk is mitigated through active participation.

- This would better visibility of financial closure, execution and exits. The operating partners will invest in the fund and the projects to have proper skin in the project.

- Various funds have already pumped $1.5 billion in distressed assets in India this year, 55% more than through all of 2019. That data only captures deals that have closed and doesn’t includes others that have been recently announced such as Oaktree’s 22 billion rupee ($294 million) loan to lender Indiabulls Housing Finance Ltd. in July.

- India in recent months has struggled to control its coronavirus epidemic, reporting the largest number of infections after the U.S. and has suffered the worst economic contraction among major economies worldwide. Yet even before the pandemic, the country had been battling one of the world’s worst bad debt problems in its financial sector, which claimed a string of lenders and left banks reluctant to lend to the most vulnerable businesses.

- The international funds are now attempting to fill that void. In doing so they face a string of challenges including India’s complicated regulatory framework and tax laws, which often require intricately structured transactions. Deals often take long to close or even fall through. Yet many investors are betting that long-term factors will bring them returns.

- India’s economic growth, demographics and stressed assets will come together in the coming decade, giving investors an opportunity of a lifetime.

- Part of the attraction for the biggest global investors is the nature of the country’s nascent financial markets. While traditional banks were focused on cleaning up their piles of bad debt, shadow lenders stepped in to keep funds flowing. But the collapse of an infrastructure financier two years ago triggered a cash crunch that has slowed lending to businesses. Mutual funds dabbling in the riskier part of the credit market have also pulled back and Franklin Templeton earlier this year suffered the biggest ever forced closure of funds in India.

- Indian banks had the world’s worst bad loan ratio among major economies even before its strict lockdown began in March, throttling economic activity. The central bank now estimates soured assets will rise to an over two decade high of 12.5% by the end of March 2021, from 8.5% a year ago, a sign of the difficulties businesses face.

- India’s domestic financial market lacks the ability to fund the risk capital needed to resolve the stressed assets that result.

- India’s underlying economy remains supported by compelling demographic and economic growth trends, creating substantial opportunities for investors.

- We expect to see a significant wave of motivated sellers of high-quality assets, and in the medium to long term, deeper balance sheet restructurings.

- But despite the rush to invest, problems remain. Funds would still like to deploy more money in India for the right deals, but also sees obstacles. One of the critical ingredients missing in the Indian system is a pre-packaged insolvency, where existing lenders, sponsors, and new money get into a room and work out a deal, and the court then blesses it.

- The influx of foreign funds may also add to competitive intensity and squeeze returns.

- Yet, India’s cleansing of its financial system has a way to run, and there’s “a ton of opportunities left,. Probably we are not even halfway through it and the stress could get worse before it gets better.

Sekhon Family Office is also partnering with India’s efforts of a new category of alternate investment fund which will focus on acquiring stressed assets from banks and shadow lenders, a move aimed at resolving some of the highest bad debt in the world.

- The fund will be allowed to buy stressed assets directly from the banks and non-banking financial companies, people with knowledge of the matter said, asking not to be identified as the matter is not public. At present, investors can only access bad loans through securities issued by asset reconstruction companies, but the new fund category will allow them to do so directly. This will give foreign investors including global hedge funds easier access to the mountain of local bad debt.

- Prime Minister Narendra Modi has been spearheading efforts to kick-start the economy and a significant part of this is based on increased lending by the banks which opens up the risk of a further increase in bad debts due to the virus outbreak. Using an alternate investment fund to buy bad debt from banks would help lighten the burden of banks as they grapple with what was the world’s worst bad loan ratio even before the virus pandemic virtually halted economic activity through the world’s biggest lockdown.

- The discussions are at a very preliminary stage and the aim is to supplement the efforts of asset reconstruction companies in reducing the bad loans of these lenders, the officials said. A finance ministry spokesman was not immediately available for a comment.

- Alternate investment funds are a home-grown and locally regulated class of hedge funds, that have increasingly become popular vehicles for a range of investors from wealthy local investors to global distressed credit funds to use. Investors must commit at least 10 million rupees, and largely comprise global hedge funds, wealthy local investors, and the investment vehicles of tycoons.

SFO MSME / SME Fund

- SFO, manager of direct equity investment funds in worldwide markets in NA, LATAM, EMEA and APAC, is pleased to announce the establishment of a fund dedicated to investing in small and medium enterprises (the “Fund”). The Fund will consist of two separate investment vehicles, one of which will be subscribed for in rupees, and the other established offshore, which will be subscribed for in US Dollars. The Fund will be managed by an registered entity. The Fund is sector agnostic and will focus on investing in growth-orientated enterprises engaged in a variety of sectors, including, but not limited, to information technology and bio-technology, agri-business, specialized distribution, and retail. An important aspect of the Fund is SFO’s partnership with the Small-Scale Industrial Development Banks worldwide and its venture network.

- In addition to its seminal investment commitment in the Fund, these banks and their ventures will work together with SFO and the Fund to identify appropriate investment candidates throughout world for investment. SFO, in addition to its investment commitment, will also be involved in the management of the Fund focusing on SME’s & early stage investments.

- The Fund is approaching a first closing of $20 million, with a second closing targeting an additional amount between $10 and $20 million. As with SFO’s other funds, it is anticipated that private investors will be attracted by both SFO’s track record of investment success as well as by the commitment of associate banks and other public sector national and international investors in support of SMEs.

- In addition to its fund offices in Central and Eastern Europe, Latin America, Central Asia, and China, SFO also has business development offices in the Netherlands and Brussels, and in Washington, DC. SFO will utilize its network to help the Fund’s portfolio companies reach international markets. Technical assistance is an integral component of SFO’s investment strategy, utilizing both internal and external operational and marketing experts to help portfolio companies grow and prosper.

- We are excited about the prospects of the Fund, not only because of exceptional base of promising SMEs involved in IT, but also because of an impending explosion of opportunities in the domestic market, given consolidation trends in a number of key sectors. Working with the experienced and well-established local partners will help us realize the potential we see in SME’s.

- Our worldwide network and experience will add a critical component to the realization of the terrific opportunities we sees in small scale enterprises.

- We believe the time is ripe for a fund targeting not only entrepreneurs engaged in innovative information technology, but also in sectors such as specialized distribution and value-added processing.

- The importance of small and medium-sized enterprises as engines of job creation and economic development is widely appreciated. Increasingly, international financial institutions, local governments, and private investors are investing in investment funds that will provide capital to these companies, along with integrated management assistance to their managers, and in particular help in exporting product regionally and internationally.

- With many years’ of experience, more than 200 investments, billions under management in funds located around the world, SFO is uniquely equipped to initiate and manage investment funds in these markets. SFO has invested billions worldwide and has achieved exits from hundreds such investments at a gross internal rate of return in excess of 27% in US Dollars. SFO SME is a separate US holding company that manages privately-held SME equity funds internationally.

Overview

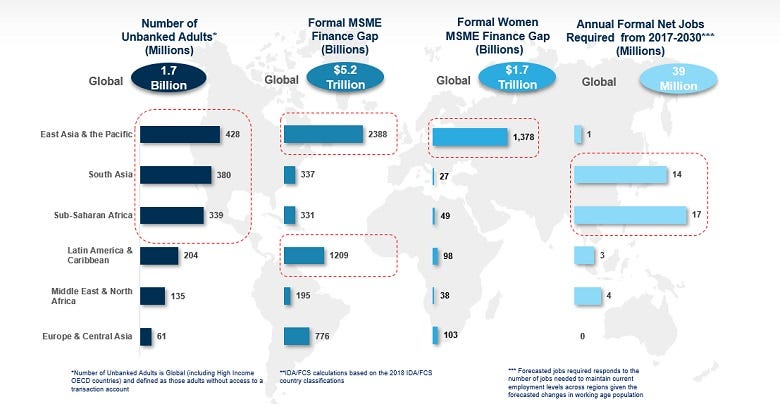

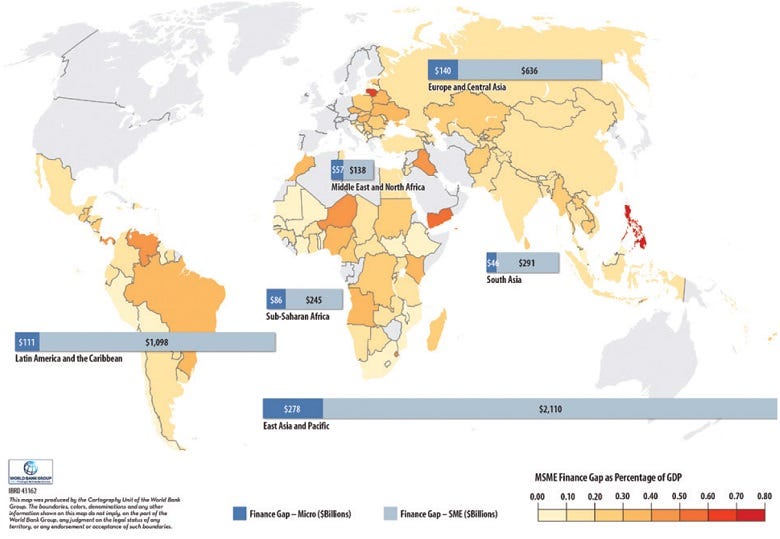

- Small and Medium Enterprises (MSME/SMEs) play a major role in most economies, particularly in developing countries. SMEs account for the majority of businesses worldwide and are important contributors to job creation and global economic development. They represent about 90% of businesses and more than 50% of employment worldwide. Formal SMEs contribute up to 40% of national income (GDP) in emerging economies. These numbers are significantly higher when informal SMEs are included. According to our estimates, 600 million jobs will be needed by 2030 to absorb the growing global workforce, which makes SME development a high priority for many governments around the world. In emerging markets, most formal jobs are generated by SMEs, which create 7 out of 10 jobs. However, access to finance is a key constraint to SME growth, it is the second most cited obstacle facing SMEs to grow their businesses in emerging markets and developing countries.

- SMEs are less likely to be able to obtain bank loans than large firms; instead, they rely on internal funds, or cash from friends and family, to launch and initially run their enterprises. The International Finance Corporation (IFC) estimates that 65 million firms, or 40% of formal micro, small and medium enterprises (MSMEs) in developing countries, have an unmet financing need of $5.2 trillion every year, which is equivalent to 1.4 times the current level of the global MSME lending. East Asia And Pacific accounts for the largest share (46%) of the total global finance gap and is followed by Latin America and the Caribbean (23%) and Europe and Central Asia (15%). The gap volume varies considerably region to region. Latin America and the Caribbean and the Middle East and North Africa regions, in particular, have the highest proportion of the finance gap compared to potential demand, measured at 87% and 88%, respectively. About half of formal SMEs don’t have access to formal credit. The financing gap is even larger when micro and informal enterprises are taken into account.

Formal MSME Finance Gap in Developing Countries

What We Do

- A key area of the SFO’s work is to improve SMEs’ access to finance and find innovative solutions to unlock sources of capital.

- Our approach is holistic, combining advisory and lending services to clients to increase the contribution that SMEs can make to the economy including underserved segments such as women owned SMEs.

- Advisory and Policy Support for SME finance mainly includes diagnostics, implementation support, global advocacy and knowledge sharing of good practice. For example we provide;

- Financial sector assessments to determine areas of improvement in regulatory and policy aspects enabling increased responsible SME access to finance

- Implementation support of initiatives such as development of enabling environment, design and set up of credit guarantee schemes

- Improving credit infrastructure (credit reporting systems, secured transactions and collateral registries, and insolvency regimes) which can lead to greater SME access to finance.

- Introducing innovation in SME finance such as e-lending platforms, use of alternative data for credit decisioning, e-invoicing, e-factoring and supply chain financing.

- Policy work, analytical work, and other Advisory Services can also be provided in support of SME finance activities.

- Advocacy for SME finance at global level through participating and supporting G20 Global Partnership for Financial Inclusion, Financial Stability Board, International Credit Committee for Credit Reporting on SME Finance related issues.

- Knowledge management tools and flagship publications on good practice, successful models and policy frameworks

Lending Operations:

- SME Lines of Credit provide dedicated bank financing — frequently for longer tenors than are generally available in the market — to support SMEs for investment, growth, export, and diversification.

- Partial Credit Guarantee Schemes (PCGs) — the design of PCGs is crucial to SMEs’ success, and support can be provided to design and capitalize such facilities.

- Early Stage Innovation Finance provides equity and debt/quasi-debt to start up or high growth firms which may otherwise not be able to access bank financing.

SME Ventures’ innovative program

- SME Ventures’ innovative program provides both risk capital to entrepreneurs and fund managers in the world’s most challenging markets. The need for risk capital is enormous in fragile and frontier countries, where acute development needs persist, often compounded by devastating effects of conflict.

- Small and medium enterprises (SMEs) in these countries have the potential to drive much-needed job creation and economic growth — but they have little access to the capital they need to thrive. They are typically too large to be served by microfinance institutions, yet too small and too recently established to be served by commercial banks. They also face other challenges, such as a lack of management skills or industry knowledge.

- By providing these entrepreneurs with risk capital — such as equity, loans, and quasi-loans — combined with some targeted technical assistance, SME Ventures is already seeing results. At the local level, investee firms have expanded their businesses, created significant numbers of jobs, and provided essential goods and services to their local populations. SME Ventures also provides support to fund managers as they establish themselves in these difficult markets.

- On a wider economic level, SME Ventures has paved the way for other private equity firms to enter these markets, by working with governments to create a regulatory environment conducive to private equity investments — and by providing a powerful signaling effect to indicate the presence of a viable private equity market in these countries.

- Having invested in multiple funds covering over 30 countries, SFO is now growing the program adding new funds on an ongoing basis.

Early-Stage SME Finance

- In Lebanon, the Innovative Small and Medium Enterprises (iSME) project is a $30 million investment lending operation providing equity co-investments in innovative young firms in addition to a grant funding window for seed stage firms. As of August 2019, iSME’s co-investment fund has invested $10.23 million across 22 investments and has been able to leverage $25.47 million in co-financing, demonstrating its ability to crowd in private sector financing and expand the market for early stage equity finance in Lebanon. To date, 60 out of 174 grantees had leveraged the iSME funding to raise a total of $13.1 million from various funding sources, a leverage ratio of 5.3 times. Overall, stakeholders’ consultations suggest that the iSME project could play an even larger role in the future financing of the Venture Capital (VC) sector by supporting existing VCs and emerging players, including increasing attention on a fund of funds approach, which could also cover growth funds (later stage and private equity).

- In India, MSME Growth, Innovation and Inclusive Finance Project improved access to finance for MSMEs in three vital but underserved segments: early stage/startups, services, and manufacturing. A credit line of $500 million, provided to the Small Industry Development Bank of India (SIDBI), was designed to provide an affordable longer-term source of funding for underserved MSMEs. Technical assistance of about $3.7 million complemented the lending component and focused on capacity building of SIDBI and the participating financial institutions (PFIs). In addition to directly financing MSMEs, disbursing a total of $265 million in loans, the project pushed the frontiers of MSME financing through the development of innovative lending methods that reduced turnaround time, reached more underserved MSMEs, and crowded in more private sector financing. It also reached new clients, women-owned MSMEs, and MSMEs in low-income states. The project supported SIDBI to scale-up of the Fund of Funds for Startups, which aims to indirectly disburse $1.5 billion to startups by 2025. SIDBI’s “contactless lending” platform, a digital MSME lending aggregator and matchmaking platform, has crowded in $1.9 billion of private sector financing for MSMEs, making it the largest online lender in India.

Lines of Credit

- In Jordan, two lines of credit aim to increase access to finance for MSMEs and ultimately contribute to job creation. The $70 million line of credit encouraged the growth and expansion of new and existing enterprises, increasing outreach to MSMEs, 58% of which were located outside of Amman and 73% were managed by women. The line of credit directed 22% of total funds to start-ups. The project financed 8,149 MSMEs, creating 7,682 jobs, of which 79% employed youth and 42% hired women. The additional financing of $50 Million is progressing well towards achieving its intended objective. $45.2 million has been on-lent to 3,345 MSMEs through nine participating banks. The project is especially benefiting women, who represent 77% of project beneficiaries, and youth (48% of project beneficiaries), and increasing geographical outreach, as 65% of MSMEs are in Governorates outside of Amman.

- In Nigeria, the Development Finance Project supports the establishment of the Development Bank of Nigeria (DBN), a wholesale development finance institution that will provide long-term financing and partial credit guarantees to eligible financial intermediaries for on-lending to MSMEs. The project also includes technical assistance to DBN and participating commercial banks in support of downscaling their operations to the underserved MSME segment. As of May 2019, the Development Bank of Nigeria credit line to PFIs for on-lending to MSMEs has disbursed US$243.7 million, reaching nearly 50,000 end-borrowers, of which 70% were women, through 7 banks and 10 microfinance banks.

Partial Credit Guarantees

- In Morocco, the MSME Development project aimed to improve access to finance for MSMEs by supporting the provision of credit guarantees by enabling the provider of partial credit guarantees in the Moroccan financial system to scale up its existing MSME guarantee products and introduce a new guarantee product geared towards the very small enterprises (VSEs). As a result of the project, the number and volume of MSME loans are estimated to have increased by 88% and 18%, respectively, since the end of 2011. Cumulative volume of loans backed by the guarantees during the life of the project is estimated at $3.28 billion. With significantly increased lending supported by guarantees, PFIs were able to continue building their knowledge of MSME customers, refining their systems to serve them more effectively and efficiently. Owing to guarantees, many first-time borrowers were able to generate credit history, which made it easier for them to obtain loans in future.

Supporting Women-Owned SMEs

- In Ethiopia, the Women Entrepreneurship Development Project (WEDP) is an IDA operation providing loans and business training for growth-oriented women entrepreneurs in Ethiopia. After identifying a persistent ‘missing middle’ financing gap for women entrepreneurs in Ethiopia, WEDP launched as a microfinance institutions’ (MFIs) upscaling operation, helping Ethiopia’s leading MFIs introduce larger, individual-liability loan products tailored to women entrepreneurs. WEDP loans are complemented through provision of innovative, mindset-oriented business training to women entrepreneurs. As of October 2019, more than 14,000 women entrepreneurs took loans and over 20,000 participated in business training provided by WEDP. 66% of WEDP clients were first-time borrowers. As a result of the project, participating MFIs increased the average loan size by 870% to $11,500, reduced the collateral requirements from an average of 200% of the value of the loan to 125%, and started disbursing $30.2 million of their own funds as WEDP loans. The average WEDP loan has resulted in an increase of over 40% in annual profits and nearly 56% in net employment for Ethiopian women entrepreneurs.

- In Bangladesh, the Access to Finance for Women SMEs Project aims to create an enabling environment to expand access to finance to women SMEs (WSME) by supporting the establishment of credit guarantee scheme (CGS), issuance of SME Finance Policy, and strengthening capacity of the regulator and sector. The project supported the issuance of Bangladesh’s maiden SME Finance Policy: stepping stone for boosting SME financing. Bangladesh’s first comprehensive SME Finance Policy was launched in September 2019 through concerted efforts in high-level upstream work, enhancement of the regulator’s capacity, and formulation of key recommendations with a sharper gender lens. In Bangladesh, $2.8 billion financing gap prevails in the MSME sector, where 60% of women SME’s financing needs are unmet, and lack of access to collateral is one of the key hindrances. Bangladesh lacked a single policy with systemic plan to enhance SME finance. With nearly 10 million SMEs contributing to 23% of the GDP, 80% of jobs in the industries sector and 25% of the total labor force, the SME Finance Policy will play a pivotal role in enhance SME financing.

Leasing

- In Ethiopia and Guinea, the World Bank Group is supporting the local governments in creating an enabling framework which is conducive to launching and growing leasing operations, as well as attracting investors, to increase access to finance for SMEs. It is doing so by working at the macro, mezzo, and micro levels, supporting the governments with legal and regulatory reforms, and working with industry players to create technical partnerships and increase market awareness and capacity. In Ethiopia, the project generated a $200 million credit facility supporting 7 leasing intuitions and introducing 4 new leasing products into the market: hire purchase, finance lease, microleasing and agrileasing. As of June 2019, 7,186 MSMEs have accessed finance valued at over $147 million. The project in Guinea supported the adoption of the national leasing law and the accompanying prudential guidelines for leasing, which in turn, have helped 3 companies to launch leasing operations. To date, these institutions have supported 31 SMEs through the disbursement of leases valued at $25 million.

Who We Work With

- Leveraging our expert knowledge, we work globally with public stakeholders and private sector intermediaries in partnership with other multilateral and bilateral development organizations to support SME Finance development in emerging markets and developing countries.